Home

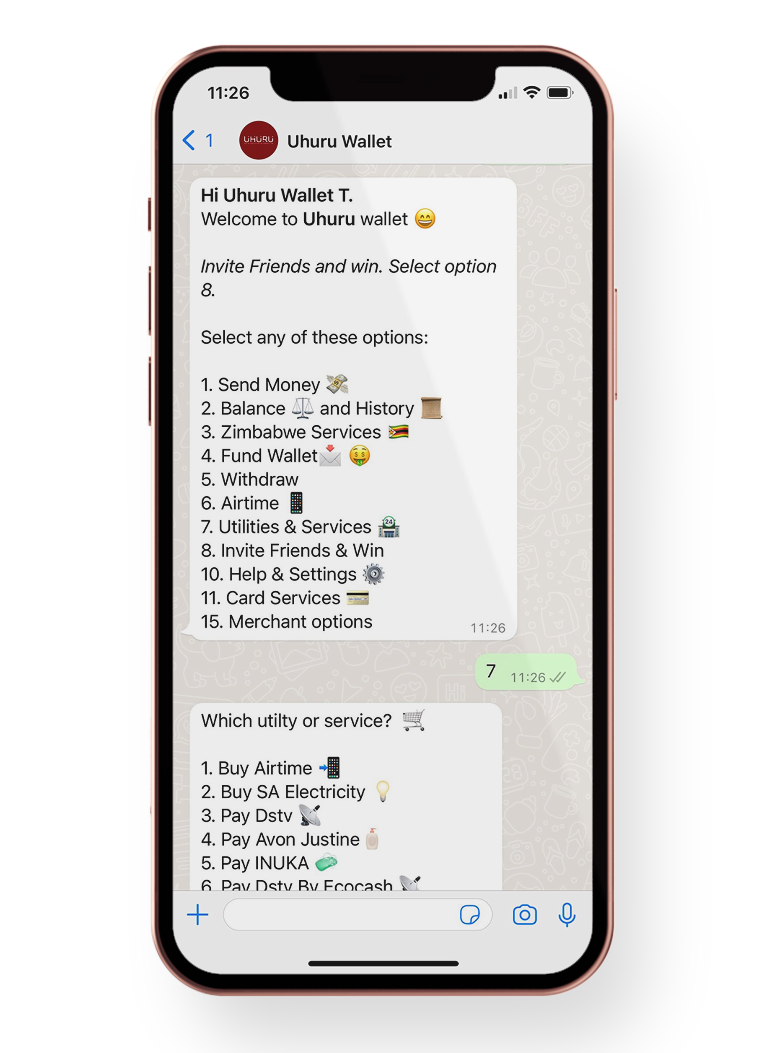

Send Money – Buy Electricity – Buy Airtime – Pay Dstv & a lot more.

How to get started

Say “Hi”

To start the conversation with the bot.

Enter your details

Provide your name, surname & email.

Verify email

An OTP would be sent to your email & SMS. enter it to verify your email.

Upload documents

To secure your wallet. Upload your identity document and selfie

Say “Hi”

To start the conversation with the bot.

Enter your details

Provide your name, surname & email.

Verify email

An OTP would be sent to your email & SMS. enter it to verify your email.

Upload documents

To secure your wallet. Upload your identity document and selfie

Funding the Wallet

Say “Hi”

To start the conversation with the bot.

Select option “4”

Fund wallet is option number 4 on the wallet menu.

Select ATM or EFT

Select the method you would like to use to make the deposit.

Enter the amount

This is the amount you want to fund the wallet.

Select the bank

A list of banks will be displayed. For example enter “1” to select Absa bank.

Go to ATM or Banking App

Enter the details provided on the ATM or Banking App. Make sure you use the reference starting with 27.

Say “Hi”

To start the conversation with the bot.

Select option “4”

Fund wallet is option number 4 on the wallet menu.

Select ATM or EFT

Select the method you would like to use to make the deposit.

Enter the amount

This is the amount you want to fund the wallet.

Select the bank

A list of banks will be displayed. For example enter “1” to select Absa bank.

Go to ATM or Banking App

Enter the details provided on the ATM or Banking App. Make sure you use the reference starting with 27.

Our Blogs

Fintech Uhuru gets RBZ tests approval

Fintech Uhuru gets RBZ tests approvalTapiwanashe Mangwiro Senior Business Reporter

According to the RBZ, the fintech regulatory sandbox, is intended for innovators in the financial services sector who have already developed their service, product, or business model and are ready to undertake a proof of concept through monitored market testing.

Uhuru founder and chief executive Trust Jakarasi said, “Uhuru is one of the two fintech start-ups included in the Reserve Bank of Zimbabwe regulatory sandbox and as a result, we have initiated testing our payments solution.”

The sandbox endeavour is supposed to bring fintech start-ups and traditional financial institutions closer together and maybe foster relations to improve financial services.

According to Mr Jakarasi, his company’s platform is especially vital for the Zimbabweans residing in neighbouring South Africa.

“We have created the perfect platform for immigrant workers living in South Africa to seamlessly support their families here in Zimbabwe,” Jakarasi added.

The testing process is in partnership with a local bank, which the fintech start-up said will announce in the coming weeks.

He added that the platform would also enable individuals as well as enterprises “to exchange value, anywhere, anytime and at affordable fees.”

This move might encourage other startups who have not signed up for the fintech regulatory sandbox in that field to approach the RBZ. The more the merrier for the central bank because it will have a larger constellation of businesses to work with and different perspectives.

Also compounding problems for the diaspora community is the strengthening US dollar, which effectively means migrants must now send more money in the currency of their residency. Since the US Federal began its regular upward adjustment of interest rates, the dollar has gained against many major currencies.

This, coupled with the high sending fees, forces migrants to opt for informal channels, which are just as efficient but not secure

According to Mr Jakarasi, Uhuru’s Whatsapp platform allows Zimbabweans living in South Africa to send as low as US$3 in the form of airtime or electricity to support families back home. Furthermore, users of the platform are also able to make other payments like hospital bills, school fees, and utility bills.

Uhuru will support this innovation via its network of agents and merchants across the country.

The sandbox guidelines set out the objectives and principles of the testing framework, and provide guidance to the applicant on the application process and the information to be provided to the Reserve Bank of Zimbabwe.

The RBZ said, “The sandbox activities, which shall be tested, are those, which the Reserve Bank would be able to oversee in terms of the Reserve Bank Act, Chapter 22:15; Banking Act, Chapter 24:20, the National Payment Systems Act, Chapter 24:23; the Money Laundering And Proceeds Of Crime Act, Chapter 9:24; Exchange Control Act Chapter 22:05 and any other relevant regulations.”

In his 2022 mid-term monetary policy statement, Reserve Bank of Zimbabwe (RBZ) Governor John Mangudya insisted that the inclusion of Uhuru Innovative Solutions and Llyod Crowd Funding in the sandbox proved the RBZ’s “commitment to promoting responsible innovation.” At the time, the RBZ governor revealed that while Llyod Crowd Funding had already commenced, Uhuru would only start at a later date.

Oct 26, 2022 Uhuru WhatsApp Wallet offers remittance, cross-border payments & more

Uhuru WhatsApp Wallet offers remittance, cross-border payments & moreHaving accounted for all of this the founders sought to create a platform that would have people move away from cash-based transactions as well as send money back home.

Uhuru Wallet services

The second thing that makes Uhuru different is that as much as the company is a remittance service it also sought to offer Zimbabweans abroad a means of paying for services that their loved ones at home would otherwise pay for with the money they are sent.

A Zimbabwean migrant living in South Africa can pay for utilities like electricity, purchase airtime and DStv for their friends and family back home. The wallet’s services also cover Malawi, and Nigeria.

The final aspect of Uhuru that makes it different is that it is a purely instant messaging-based service. WhatsApp is, at present, the messaging service that Uhuru operates from. So you can (via WhatsApp):

1) Send money peer-to-peer in South Africa,

2) Send money to anyone in the SA, Zimbabwe and Nigeria.

3) Cross Border Payments for DSTV, Avon, Unuka, Airtime and Electricity in South Africa, Zimbabwe, Malawi, and Nigeria

How do you register for Uhuru?

Anyone can register for Uhuru by sending “Hi” to +27 60 070 2708. You’ll then need to:

1) Enter your name

2) Your email address

3) Physical Address

4) A password

You’ll then get a One Time Password via your email, you’ll need to enter that to the chat and registration will be complete.

Crediting your Uhuru Wallet

You can put fund your wallet in South Africa by way of an ATM deposit which will carry a 5% fee. EFT (electronic funds transfer) to Uhuru is the second alternative and that has a 2.5% fee.

After having done that you can send money over Uhuru (peer-to-peer), to the recipient’s bank account, EcoCash wallet or pay for the previously mentioned services. If you live in Zimbabwe you can use your Uhuru Wallet through your EcoCash wallet to pay for your DStv and send money peer-to-peer.

Uhuru also has a blockchain aspect to it by way of Stellar‘s services which the company plans to use to expand across Southern and Eastern Africa as well as Asia.

“Uhuru has set out to create a borderless ecosystem in which persons and enterprises can make near-instant transactions using their instant messaging platforms anytime anywhere at affordable fees.”

May 27, 2022 Blockchain startup Uhuru Wallet included in RBZ Fintech Sandbox

Blockchain startup Uhuru Wallet included in RBZ Fintech SandboxWhile the blockchain is often touted as a game-changing technology that is capable of disrupting traditional finance, it is yet to fulfil this promise.

The race to satisfy this pledge is still on but numerous obstacles such as regulatory uncertainty are standing in the way.

For different reasons, regulators in some parts of the world including in Africa are still sceptical of the blockchain. The fact that the blockchain is the technology that anchors bitcoin makes it less than ideal technology to use. Compounding the problem are the many misconceptions about cryptocurrencies and bitcoin in particular.

Still, even as they exhibit some form of apprehension towards the technology, a few regulators are also resigned to the fact that the blockchain is not going anywhere. Therefore, to prepare themselves for the coming era wherein the blockchain is at the epicentre of finance, these regulators are looking at ways they ease in the technology whilst maintaining control.

Nevertheless, regulators or central banks lack the capacity and technical know-how to build solutions in the space. To overcome this challenge it is, therefore, logical for them to partner with private fintech startups that possess the required skills.

In Zimbabwe, the Reserve Bank of Zimbabwe (RBZ) could well be attempting to do just that through its FinTech sandbox. The central bank has onboarded Uhuru Innovative Solutions to the sandbox, a fintech firm behind the WhatsApp-based payment solution. As a result of this coming together, the latter, which already harnesses the Stellar blockchain, has created a platform specializing in low and mid-value payments that enable users in Zimbabwe and South Africa to make instant payments using stable coins.

112 RBZ fintech sandbox registrations but what has it achieved in nearly a year?

Users (who must all do a KYC) will be able to make low-value payments for things like DSTV, Electricity, Airtime or Utility Bills from anywhere once their wallet is funded. The latest addition to the platform allows Telone and Zol customers to pay or top up their accounts. For Inuka and Avon agents, Uhuru Wallet also provides a convenient payment solution which allows users to make payments for their orders.

For Zimbabweans without a bank account or those living as undocumented migrants in countries like South Africa, Uhuru wallet allows them to pay for school fees, hospital bills and other utilities. For example, a Zimbabwean living and working in South Africa can pay directly for their monthly funeral policy subscriptions or pay for a loved one’s water bill without the need of a third party.

An estimated three million Zimbabweans work and live in South Africa while maintaining ties with their home country, where they customarily send remittances and cater for their families. Since this payment solution is available, the wallet potentially becomes another secure and cheaper remittance channel available to them. For those concerned about the security of their funds, Uhuru’s anchor technology the blockchain enables regulators like the RBZ to monitor and flag transactions in real-time.

You can check out Uhuru Wallet for yourself by chatting with +27600702708 on WhatsApp

Also check out:-

Uhuru WhatsApp Wallet offers remittance, cross-border payments & more

May 27, 2022 Migrant Workers and Remittances

Migrant Workers and RemittancesIt is well known that remittances have kept Sub-Saharan Africa ticking for many years. Millions have fled their countries of birth due to economic crisis or war crimes. Desperate to provide for their families they have braved new worlds, often finding themselves in nations where they do not so much as speak the language. As their families’ only hope, migrants have taken up menial jobs that local residents regard as beneath them. The majority of those significantly small wages are sent home every month. These salaries are what those left at home depend on for all their needs such as food, water, medical supplies, clothing, school fees and transport. In some instances, these funds are utilised to assist their loved ones to start informal businesses.

Over the years remittances to developing nations have reached over 500 billion USD annually. These nations depend on these funds to inject life into their economies. GDP is significantly impacted by these remittances. For instance, in South Sudan it is estimated that remittance flow made up 34,4% of the country’s GDP.

It is reported that Sub-Saharan Africa is the most expensive region to send money to due to lack of competition. It can cost up to 9% of the value of the transaction. For migrant workers that earn very little this can be prohibitive. A study has shown that South Africa is one of the most expensive countries to send money from; this is concerning as it hosts the bulk of migrant workers on the continent. It is imperative that organisations such as Uhuru Wallet grow their base and take up space to ensure that migrant workers have alternative solutions to send money home and support their families in their home countries. By enabling migrants to pay for utilities and services such as airtime and DSTV (cable TV) for the families back home on their platform Uhuru not only provides convenience but reduces the cost of those transactions.

Through innovation and strategies such as tokenization, the world of remittances is constantly changing and starting to benefit those that have given up everything they know for their survival as well as their families’. Technology has become the great equalizer and is bringing much needed competition into the market. We will surely continue to see continued innovation as more African start ups pop up and are getting funding and recognition in the space.

Nov 24, 2020 Financial Inclusion Post Covid-19

Financial Inclusion Post Covid-19The global Covid19 pandemic has, along with the catastrophic loss of life, had an adverse and far-reaching impact on the global economy, last seen a century ago. The contagiousness of the virus has forced a change in behaviour, most notably, social distancing, to curtail its exponential spread.

Consequently, there has been an increase in the use of digital communication tools as firms sought new ways of continuing with provision of services while maintaining limited physical contact. The same reason has seen a rise in the adoption of digital financial solutions as economies pushed to tick along during the pandemic. Non-direct and cashless methods of transacting and accessing financial services have become the preferred, if not the only, solution in the different stages of lock-down experienced the world over. Financial inclusion has meant much more in these times than ever before as the conventional means of accessing goods and services became, to a large extent, untenable.

From a macroeconomic perspective, financial inclusion has been proven to spur economic growth as participation in the economy is broadened especially in the low-income segments. This is particularly important for the global economy that is yet to emerge from the aftermath of the pandemic. This type of economic growth has also proven effective in narrowing income inequality.

Ordinarily, the increased adoption of digital financial services has been higher in countries with lower traditional financial penetration, primarily Africa and Asia. It is important to note, however, that the challenges constraining financial inclusion which existed before the pandemic are still present. These countries are characterised by low mobile penetration, limited access to the internet, prohibitive internet data cost, low literacy amongst target users as well as digital security concerns. However, necessity brought about by the pandemic is dropping the threshold for experimenting with non-traditional digital financial products.

The prevailing conditions are also conducive to introduction of innovative products into the market given the natural pull of a captive market and subsequent likelihood of reaching critical mass for adoption of a particular service offering. This is requisite in making these services economically viable. As an example, a remittances company in one of the countries in Africa introduced a service that enabled diaspora population to remit funds specifically for food stuff to be collected in the receiving country. There has also been adoption of digital financial services by government entities to reach non-urban population.

Increased demand for digital services has further resulted in more competition within the sector. This is necessary for innovation, product differentiation and lowering of prices. Customer experience is subsequently improved as competitors jostle for market share.

To come full circle, the regulatory framework needs to keep pace with the growth in penetration ratios and potential product proliferation. Together with the service providers, authorities have an obligation to ensure that digitalisation still addresses the traditional risks inherent in financial transactions – money laundering, cyber security risks and funding of terrorism, to name a few. An enabling environment from policy makers is also needed to accelerate financial inclusion by specifically targeting technology costs, electricity connectivity and literacy, both digital and financial.

Multilateral institutions are placing high priority in encouraging growth and penetration of digital services. The main focus has been through the spearheading initiatives aimed at setting of policy guidelines that help the global economy use financial inclusion to aid broad development agenda including financial services penetration, stimulating post-pandemic economic recovery and addressing gender inequality. Mobile financial solutions, as an example, have been shown to be more effective in bridging the gender equality gap than traditional banking products.

The impact of digital financial inclusion especially in countries with low financial penetration cannot be underestimated. Coordination between policymakers and industry players and a broader global alignment has the potential to buttress the turnaround from the effects of the global pandemic and accelerate the path to more inclusive and more equal societies. Deepening of the digital ecosystem within markets creates analogous data to traditional financial and credit metrics. However, there is the added advantage of inclusion of the unbanked segments of the economy and allowing for the provision of 2nd tier services such as short term credit facilities to that segment. This is one of the important channels that has the potential of transforming the lives of low income and rural households and enjoin them to the more formal economy.

The advent of digital financial services cannot be attributed to necessity. However, the global Covid19 pandemic has certainly catalysed its adoption and penetration and played a part in advancing financial inclusion especially in developing countries where traditional banking channels have limited roll out and reach. Further, the digital financial services sector is proving essential in addressing the much needed broad-based economic turnaround with the promise of a sustainable contribution from here on.

Nov 24, 2020 Future of Payments

Future of PaymentsThe future of payments

Introduction

There has been an incredibly high mobile penetration in emerging markets over the last decade. Previously marginalised people can therefore now access financial services using mobile wallets offered by Telco’s as a result. People can perform person to person, person to merchant, person to agent transactions with mobile banking. These mobile wallets enable easier, safer, quicker, cheaper and more reliable money transfers over a long distance.

Current solutions and Challenges faced

One of the main issues being experienced with the telco based mobile wallets is the lack of interoperability between wallets. In its most complete form, interoperability refers to interconnection across an array of use cases, including transfers between mobile money accounts or mobile money and bank accounts, both domestically and internationally. Currently, a user is only able to send funds to someone on the same mobile network as theirs or their own bank account. This leaves people with an option to either carry around different sim cards or move money from wallet to bank before they can transfer it to another person.

Generally, people in emerging markets are still very cash-based in thinking and prefer face to face interaction when making payments or sending money. This mentality has offered some resistance to the growth of penetration of mobile wallets in most places. In South Africa, for example, the products that have gained household status are those offered by banks which only allow someone to use their mobile wallet to receive money and collect at an ATM. The telco run initiatives that tried to replicate m-pesa or m-pesa itself have run into challenges in this market.

Another issue impeding the penetration of more innovative digital offerings in Africa is the availability and affordability of connectivity to the internet. The bulk of African mobile transactions are compatible with feature phones and do not require internet connectivity or NFC. The successful offerings have mostly been feature phone compatible, using the Unstructured Supplementary Service Data (USSD) protocol. It is, however, promising to note that high levels of up to 50% penetration of internet-enabled devices and the internet itself have been recorded in the last decade, for most of Sub Saharan Africa as of mid-2019.

In countries like Zimbabwe, the cost of transacting on mobile wallets has been a big issue, with service providers charging up to 4% fees for peer-to-peer transactions, including tax. Due to the high demand for cash in that country, unscrupulous merchants can charge a premium of no less than 30% for a cash-out. This has fuelled the resistance to mobile money payments with people opting for cash.

The future

Plastic money will probably be around for a while, but future solutions will find a way to integrate this very efficient way of processing payments and the new age of digital money. There will be a move from face-to-face transactions to the use of mobile devices to settle financial obligations. Companies like Visa have already started rolling out wearable devices with payment capabilities.

The new and growing trend is tokenisation, for instance, a blockchain token is issued that digitally represents a real tradeable asset. There is still a need to facilitate collaboration with regulators in this space if the full potential of this technology is to be realised. This technology or token economy represents a shift from the large centralised trust agents to the individual, with cryptology doing away with the need for third-party intermediaries by enforcing trust. Institutions experimenting with tokenisation have started issuing tokens that are either limited to a specific device, or e-commerce merchant, or a limited number of transactions. The need for seamless and secure digital payment transactions remains crucial, and tokenisation is being considered to introduce frictionless card-free payments in e-commerce environments.

Future solutions are expected to be digital-based and have increased security and interaction. New solutions are already being built on cryptographic technology in the backend, which ensures high-level security, and using encrypted social media platforms like WhatsApp in the frontend for increased interaction through a chatbot, e.g. Uhuruwallet.

Developed countries are already making use of super apps which house all essential services under one application for ease of use and payment e.g. WeChat.The concept of the internet of money is likely to go mainstream in the coming years. Forward-thinking central banks have started exploring the option for issuing a blockchain-based Central bank digital currency (CBDC). This can potentially disrupt the whole banking sector as the central bank becomes deposit-taking and therefore transaction clearing, for individuals, not only financial institutions. Blockchain ledgers will be the natural choice when this is implemented due to their immutability, auditability and KYC compliance capability.

Conclusion

Whatever the case, it appears a cashless society is becoming a reality each day through various forms of electronic money services being offered. The first hurdle is to make the process of in-person digital transactions easy and secure. A more practical approach is to break down the issue into smaller solutions, for instance solving a practical problem like how to split the restaurant bill digitally. Africa looks ready for the disruption, with some already experiencing it.

Feb 20, 2020Enablers